fha gift funds for down payment

The FHA Federal Housing Administration is the easiest path to homeownership. In this article we will discuss the FHA down payment requirements for homebuyers.

The Low Down On Gift Funds Pacres Mortgage

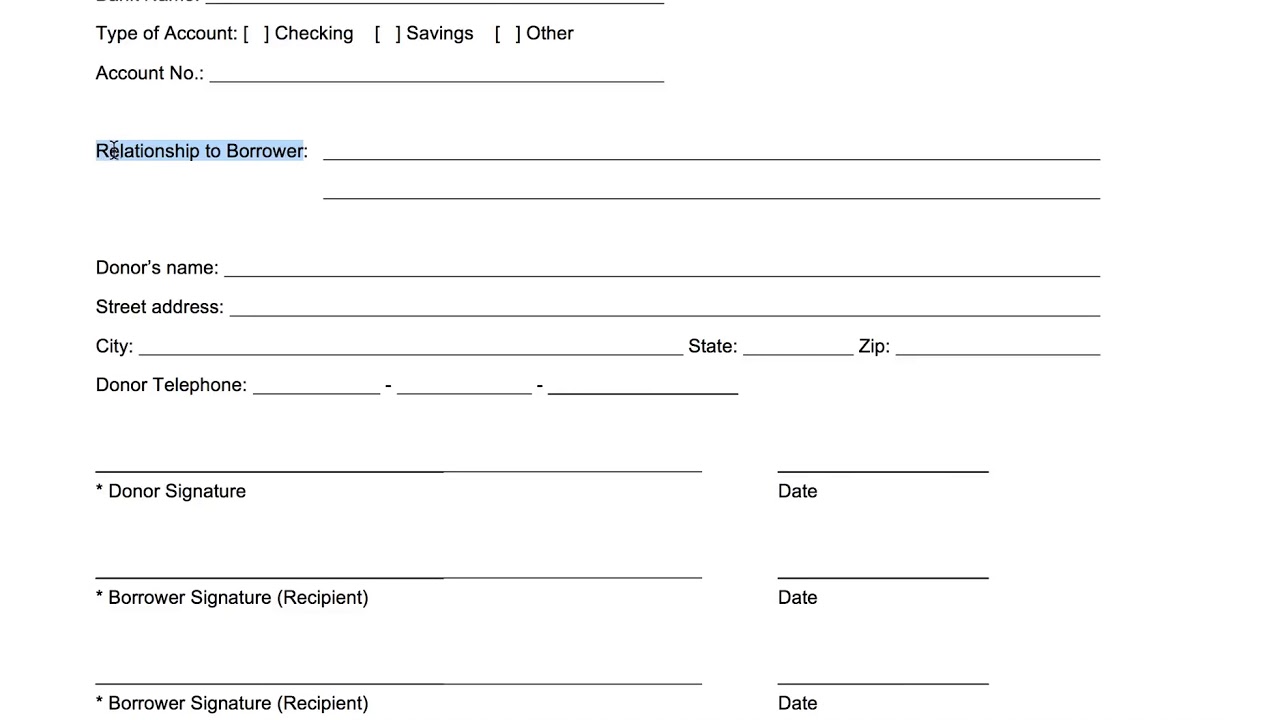

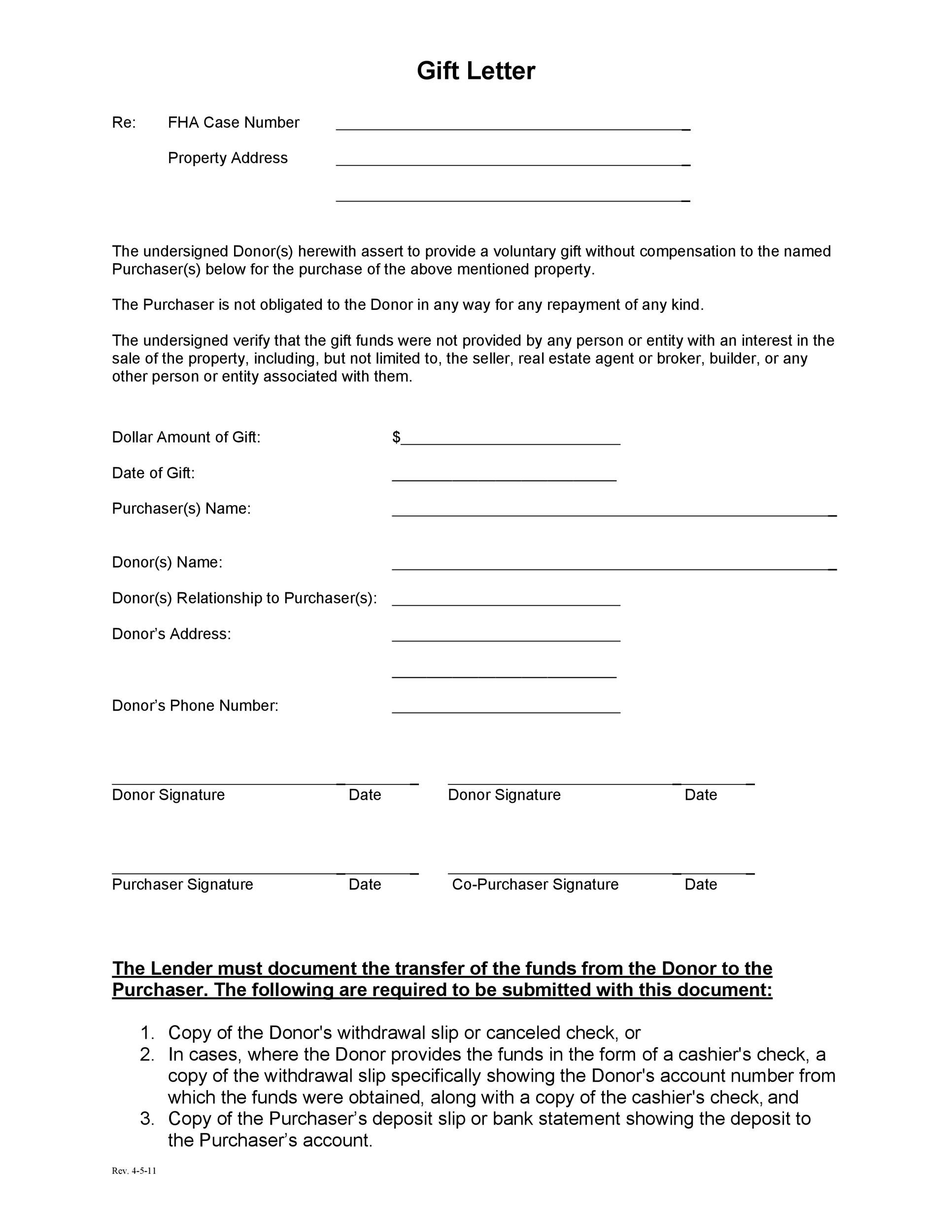

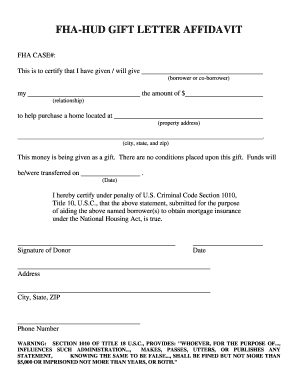

A statement that no repayment is required.

. HUD 40001 instructs the lender to obtain a gift letter signed and dated by the donor and Borrower that includes the following. The ability to utilize an FHA-insured home loan by offering eligible applicants 35 of the purchase price to cover the down-payment. How to give or receive a down payment gift.

And for down payment gift funds that do. Gift funds are a very popular way of paying a down payment or for paying closing costs pre-paids when purchasing a home. Gift of equity 35 down payment.

Not anyone can gift. Family Members Friends Employers. The seller is allowed to pay up to 6 of the sales price toward.

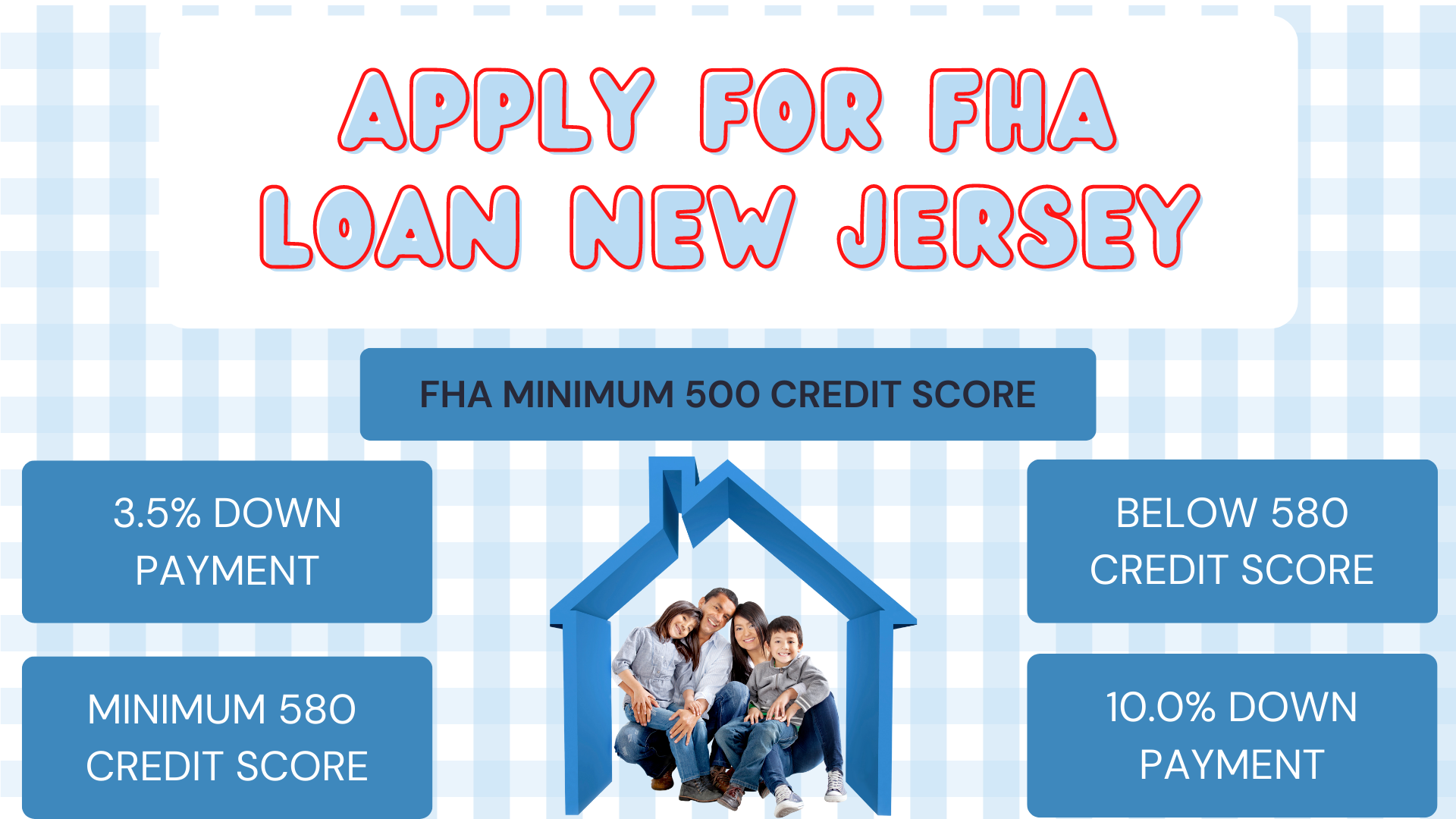

How Do Lenders View Gift Funds. Most home buyers who use FHA come up with at least 35 percent down from their own funds. FHA Down Payment Grants for 2022.

You can only spend FHA gift money on specific payments in the house purchase. Using gift money with an FHA loan. FHA Gift Fund Uses.

They may be spent on the following items. As part of the down payment. You can have the money gifted to you but you cannot borrow it from someone else.

January 21 2022 - 6 min read. For example no one with a financial stake in the outcome of the FHA loan can provide down payment gift funds for a borrower. Gift Funds Guidelines for FHA Loans.

The portion of the gift not used to. That 35 must come from an. FHA down payment requirements for home purchases.

FHA requires 35 of the purchase price as a down payment. FHA loan rules require all new purchase loans for single family residences to include a minimum cash investment from the borrower of 35. The Federal Housing Administration offers the FHA loan for borrowers with low-to-moderate income levels.

FHA guidelines for gift funds. HUD Handbook 40001 outlines the acceptable down payment sources for FHA loans. FHA gift funds are assets given from a donor to a borrower via cash or equity with no expectation of repayment.

Although FHA allows 100 gift funds to be used for the down payment and closing costs lenders do not view gift funds favorably especially. Key highlights from this article. If you apply for an FHA loan your gift funds.

Borrowers who use this program to buy a house can only use funds. What are the FHA down payment requirements. Gift Funds In order for funds to be considered a gift there must be no expected or implied repayment of the funds to the donor by the borrower.

Who can gift money to the borrower. This could mean that buyers essentially can purchase a home with no cash. Essentially borrowers can use FHA gift funds toward a down.

In other words the gifted funds must truly be a gift and not a loan. However the FHA program allows.

How Much Is A Down Payment On An Fha Loan Texas United Mortgage

Mortgage Down Payment Gift Letter Overview Brian Martucci Mortgage Lender Youtube

Down Payment Gift Guidelines For Conventional Va Jumbo And Fha Mortgages

Fha Loan Rules For Down Payment Gift Funds

Fha Mortgage Loan Process Checklist Refiguide Org Home Loans Mortgage Lenders Near Me

Fha Loan Rules For Gift Funds Fha News And Views

Down Payment Programs For Truckee And North Tahoe Homebuyers

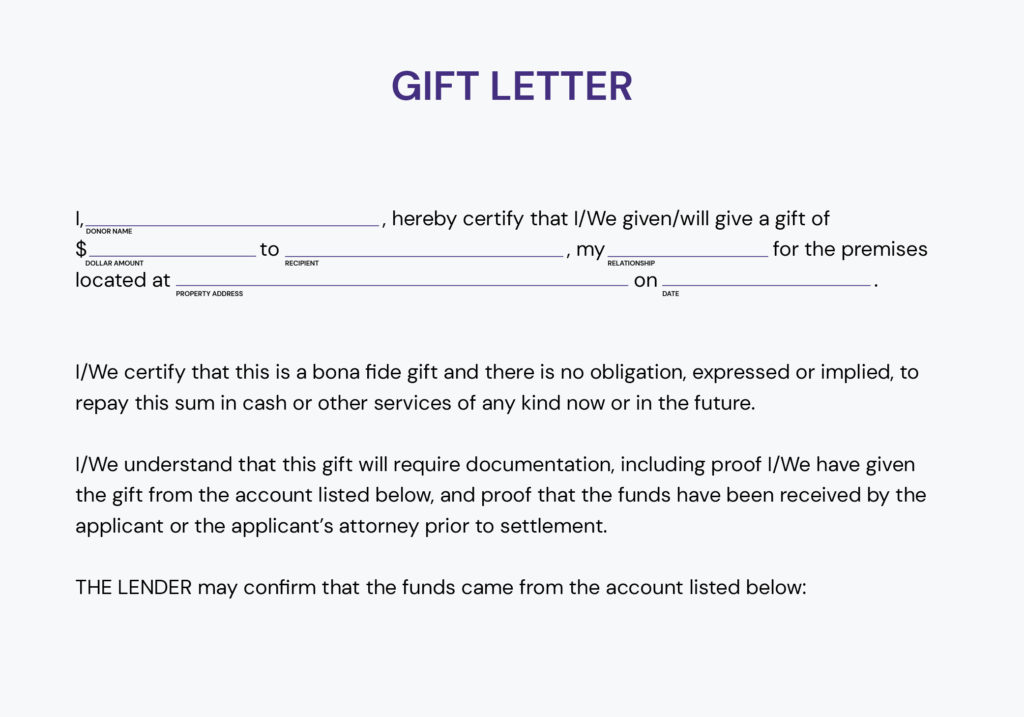

35 Best Gift Letter Templates Word Pdf ᐅ Templatelab

Gift Letter Affidavit Form Fill Out And Sign Printable Pdf Template Signnow

Gift Letter For A Mortgage What To Know And How To Use One

Fha Guidelines On Gift Funds Mortgage Requirements

Fha Downpayment Gift Funds Youtube

Conventional Mortgage 5 Down Payment 100 From Gift Funds

:max_bytes(150000):strip_icc()/rules-for-documenting-mortgage-down-payment-gifts-4157907-FINAL-9c59d5c0b3e445e1a142b323f35176e1.png)

How To Document Mortgage Down Payment Gifts

What Is A Gift Letter For A Mortgage

Down Payment Gift Rules From A Friend Or Relative

What Is A Down Payment Gift What You Need To Know

How To Use A Mortgage Gift Fund For Your Down Payment Edina Realty