nh meals tax rate

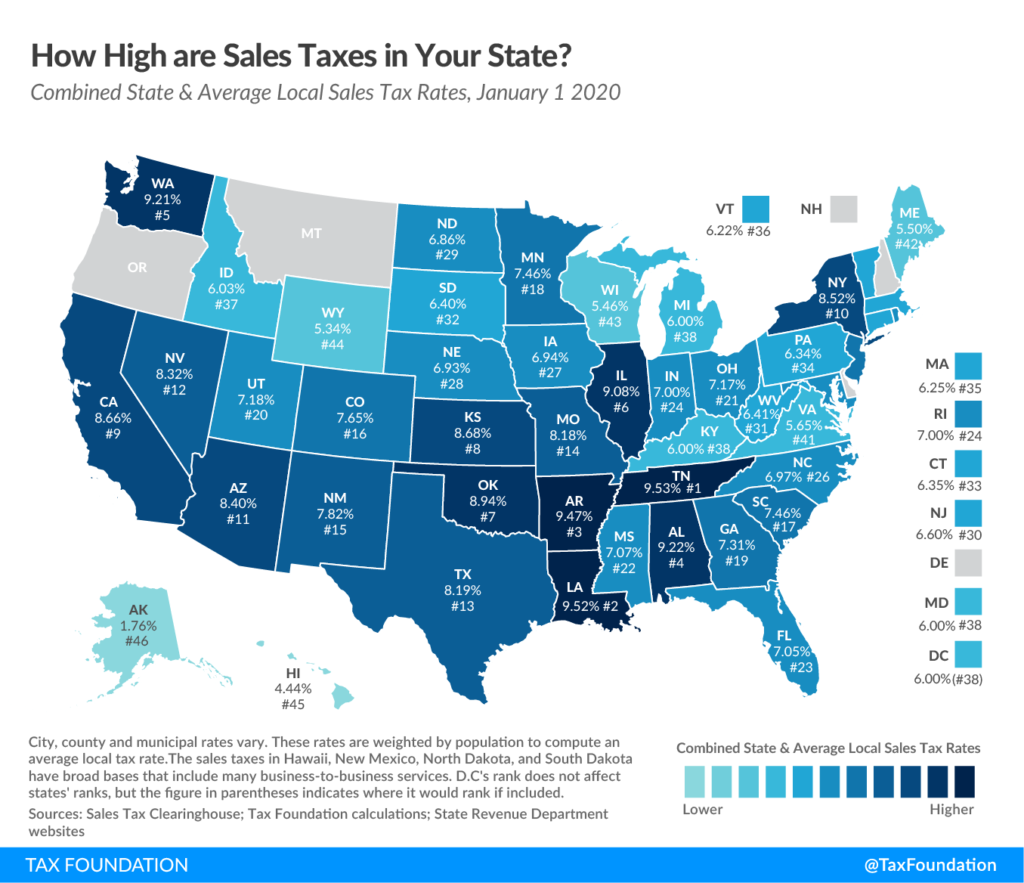

New Hampshire is one of the few states with no statewide sales tax. Years ending on or after December 31 2026 NH ID rate is 2.

Cut To Meals And Rooms Tax To Take Effect On Friday New Hampshire Bulletin

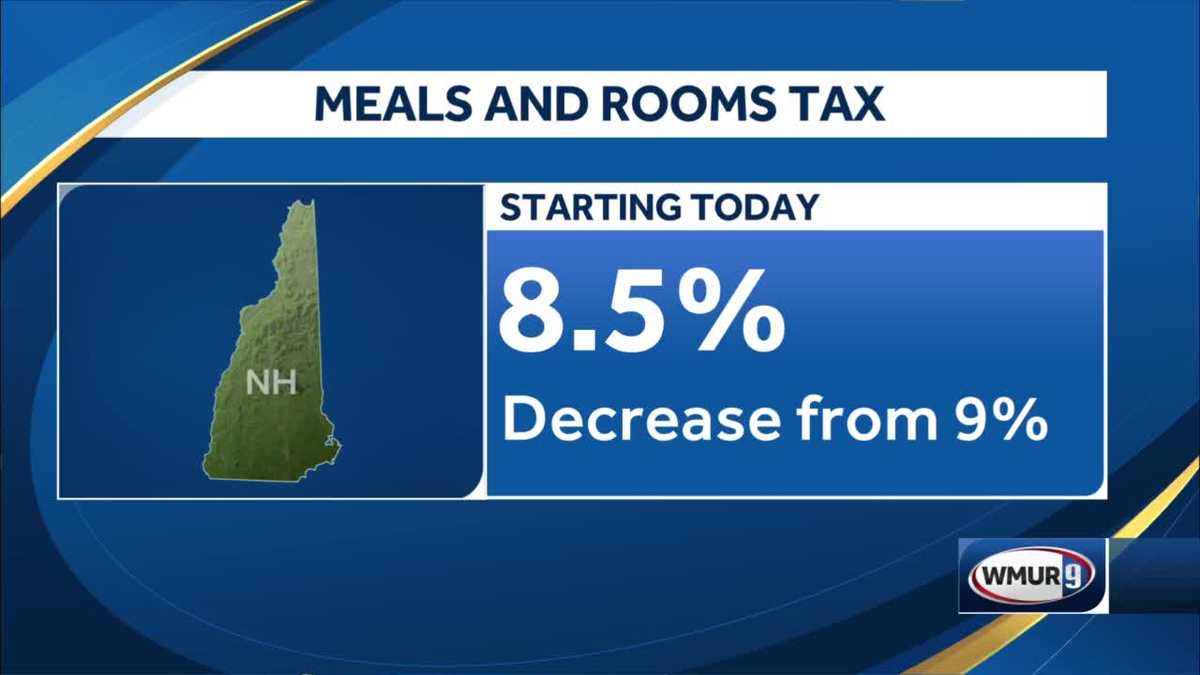

The state meals and rooms tax is dropping from 9 to 85.

. The rate is reduced to 875 beginning on or after October 1 2021. NH Meals and Rooms tax decreasing by 05 starting Friday. Advertisement Its a change that was proposed by Gov.

Motor vehicle fees other than the Motor Vehicle Rental Tax are administered by the NH Department of Safety. 2022 New Hampshire state sales tax. New Hampshire Department of Revenue Administration NHDRA is reminding operators and the public that starting October 1 2021 the states Meals and Rooms Rentals Tax ratewill decrease by 05 from 9 to 85.

Concord NH The. Exact tax amount may vary for different items. Meals and Rentals TaxRSA Chapter 78-A.

Note that in some areas items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate than general purchases. 1 those in New Hampshire eating at restaurants and food service establishments purchasing alcohol at bars staying at hotels and app-driven accommodations on Airbnb or Vrbo or renting. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

The Meals and Rentals MR Tax was enacted in 1967 at a rate of 5. Enter your total Tax Excluded Receipts on Line 1 Excluded means that the tax is separately stated on the customer receipt or check. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent.

The State of New Hampshire does not issue Meals Rentals Tax exempt certificates. A 9 tax is also assessed on motor vehicle rentals. Nh Meals And Rooms Tax Decreasing By 0 5 Starting Friday Manchester Ink Link New Hampshires meals and rooms tax decreases 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent.

To ensure a smooth transition to the new tax rate we are reminding. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. Starting October 1 the tax rate for the Meals and Rooms Rentals Tax will decrease from 9 to 85.

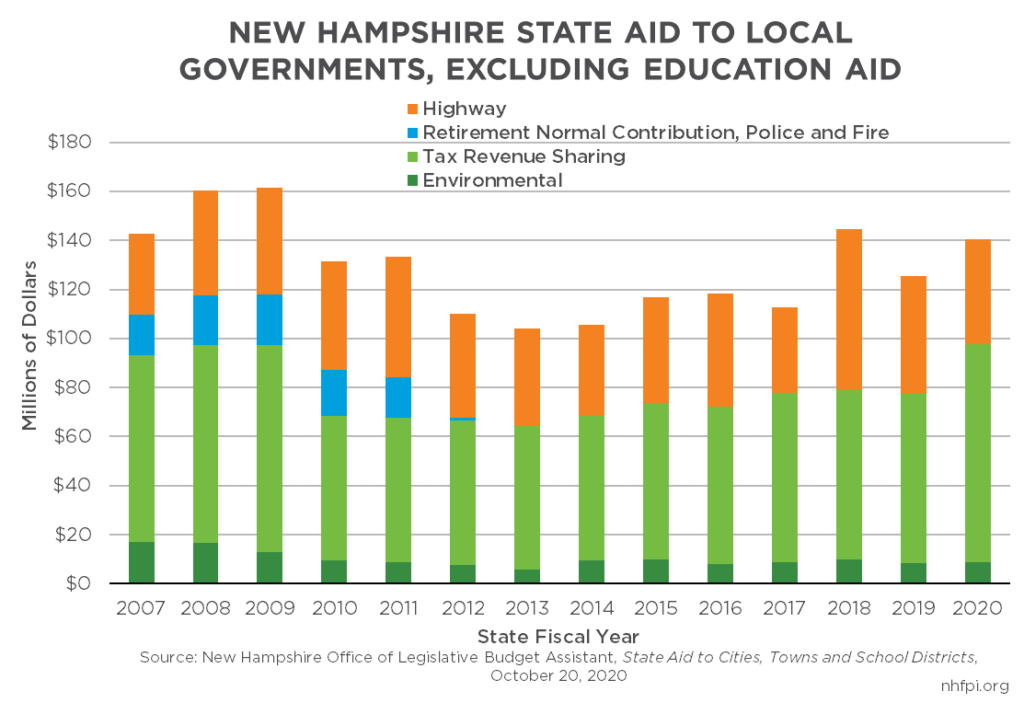

There are however several specific taxes levied on particular services or products. Reducing our MR tax rate makes New Hampshire marginally more competitive with Maine and Vermont both of which have a 9 lodging tax. Meals and Rooms Tax Where The Money Comers From TransparentNH.

The Vanguard group soon. Some rates might be different in Nashua. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0.

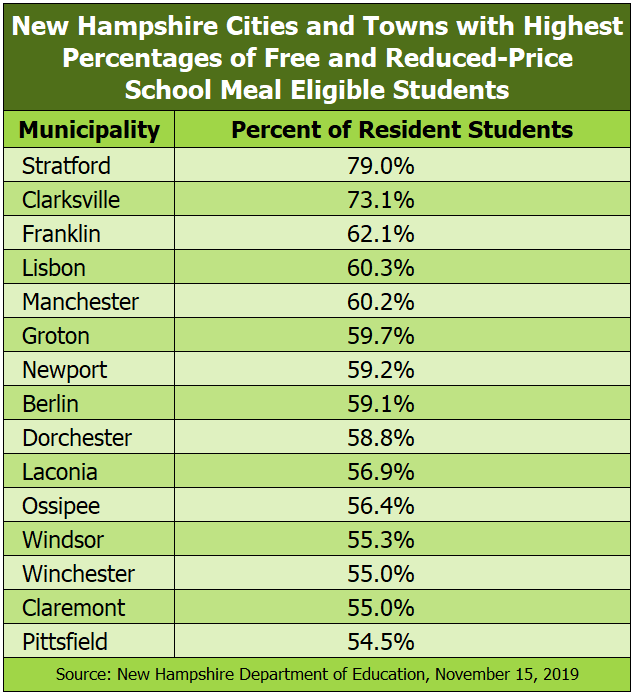

Increasing the percentage returned to towns means that even with the reduced rate towns will see an increase in the MR tax distribution. Chapter 144 Laws of 2009 increased the rate from 8 to the current rate. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more.

The current tax on NH Rooms and Meals is currently 9. Multiply this amount by 09 9 and enter the result on Line 2. The tax is assessed upon patrons of hotels and restaurants on certain rentals and upon meals costing 36 or more.

New Hampshires sales tax rates for commonly exempted categories are listed below. That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party platters. This budget helps small businesses by reducing the Business Enterprise Tax BET from 06 to 055.

New Hampshires sales tax rates for commonly exempted categories are listed below. Chris Sununu in this years budget package which passed state government in June. 18 hours agoDorsey simply responded no Musk offered to buy Twitter last week for 43 billion after saying he had become the companys largest shareholder with a 92 stake.

New Hampshires governor signed into law a two-year 135 billion budget package Friday that cuts the states business tax rates phases out the interest and. Some rates might be different in Exeter. NH Meals and Rooms Tax.

Note that in some areas items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate than general purchases. New Hampshires meals and rooms tax decreases 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent. New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals.

What is the Meals and Rooms Rentals Tax. Years ending on or after December 31 2025 NH ID rate is 3. Starting on October 1 2021 the meals and rooms tax rate was decreased from 9 to 85.

1 those in New Hampshire eating at restaurants and food service establishments purchasing alcohol at bars staying at hotels and app-driven accommodations on Airbnb or Vrbo or renting. Years ending on or after December 31 2027 NH ID rate is 0. This budget helps consumers by reducing the Meals and Rooms Tax from 9 to 85 its lowest level in over a decade.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. Concord NH The New Hampshire Department of Revenue Administration NHDRA is reminding operators and the public that starting October 1 2021 the states Meals and Rooms Rentals Tax rate will decrease by 05 from 9 to 85.

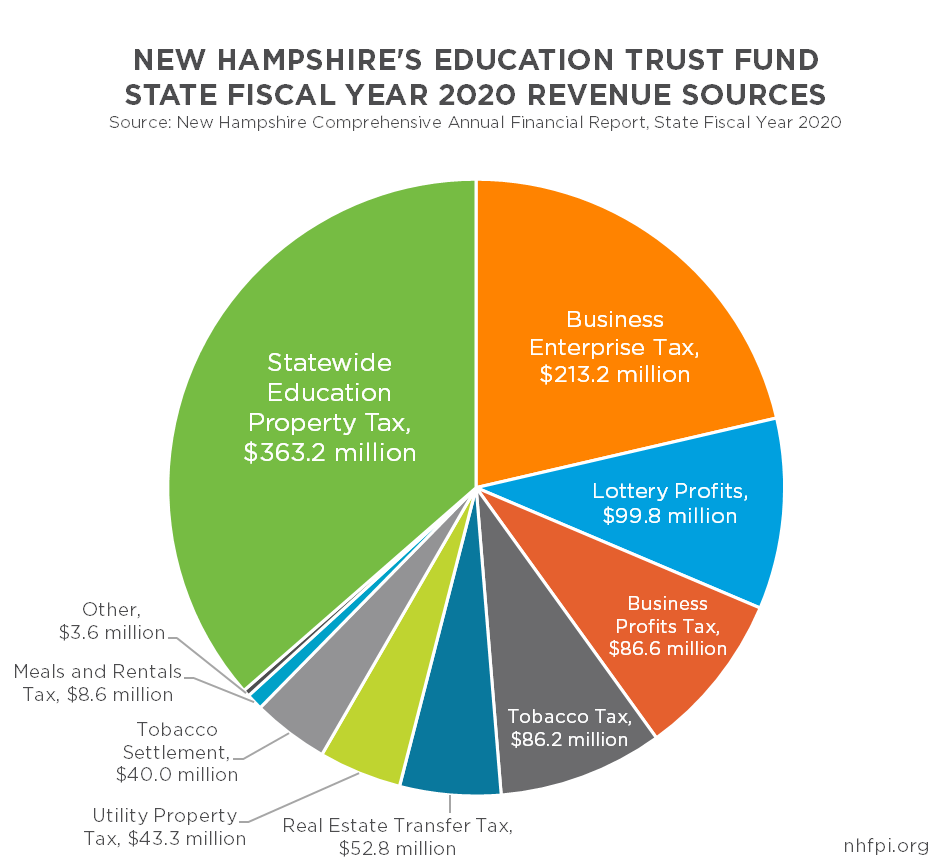

The Governor S Budget Proposal For State Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

Utah S Recent Sales Tax Reform Efforts And Sales Taxes Across The Nation Utah Taxpayers

The State Budget For Fiscal Years 2020 And 2021 New Hampshire Fiscal Policy Institute

New Hampshire Meals And Rooms Tax Rate Cut Begins

New Hampshire Sales Tax Rate 2022

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Understanding New Hampshire Taxes Free State Project

New Hampshire Sales Tax Rate 2022

Transparency Nh Department Of Revenue Administration

Sales Taxes In The United States Wikiwand

New Hampshire Income Tax Nh State Tax Calculator Community Tax

States Without Sales Tax Article

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Nh Meals And Rooms Tax Decreasing By 0 5 Starting Friday Manchester Ink Link

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

Historical New Hampshire Tax Policy Information Ballotpedia

New Hampshire Income Tax Nh State Tax Calculator Community Tax